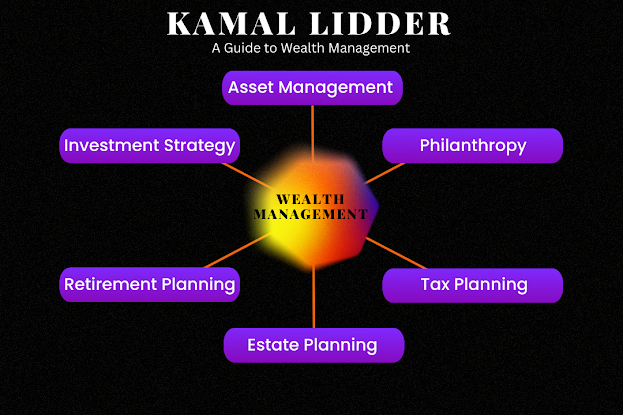

A Guide to Wealth Management with Kamal Lidder

Kamal Lidder is an investment advisor at Canaccord Genuity Wealth Management. He joined Canaccord Genuity Wealth Management, a global company that provides customized financial solutions, to provide individuals and organizations with the independent advice and guidance they need to optimize their finances. Wealth management is a comprehensive approach to managing one's financial resources, including investments, taxes, retirement, and estate planning. In this guide, we will explore the key components of wealth management and how Kamal Lidder helps his clients achieve their financial goals.

What is Wealth Management?

Wealth management is a strategic approach to managing one's

financial resources. It involves developing a comprehensive plan to manage

investments, taxes, retirement, estate planning, and more. Wealth management is

not just for the wealthy; it is for anyone who wants to take control of their

finances and plan for the future.

1. Asset Management for Professionals:

Kamal Lidder provides asset management services for

professionals, including doctors, lawyers, and business owners. He helps his

clients manage their investments, reduce their tax burden, and plan for

retirement. He understands that professionals have unique financial needs and

works with them to create customized plan that meets their goals.

2. Asset Management for Businesses:

Kamal Lidder also provides asset management services for

businesses. He helps business owners manage their investments, reduce their tax

burden, and plan for the future. He understands that businesses have unique

financial needs and works with them to create customized plan that meets

their goals.

3. Investment Strategy:

An investment strategy is a key component of wealth management.

Kamal Lidder works with his clients to develop a tailored investment strategy

that aligns with their goals, risk tolerance, and time horizon. He uses a

disciplined approach to investment management that focuses on diversification,

risk management, and long-term performance.

4. Retirement Planning:

Retirement planning is another important component of wealth

management. Kamal Lidder helps his clients plan for retirement by developing a

comprehensive strategy that includes savings, investment, and income planning.

He works with his clients to determine how much they need to save for

retirement, what investments are appropriate, and how to generate income in

retirement.

5. Estate Planning:

Estate planning is the process of managing and distributing one's

assets after death. Kamal Lidder helps his clients develop an estate plan that

minimizes taxes, protects assets, and ensures that their wishes are carried

out. He works with his clients to create a will, establish trusts, and develop

a plan for passing assets to beneficiaries.

6. Tax Planning:

Tax planning is an essential component of wealth management. Kamal

Lidder helps his clients develop a tax-efficient investment strategy that

minimizes taxes and maximizes returns. He works with his clients to identify

tax-saving opportunities, such as retirement accounts, tax-free investments,

and charitable giving.

7. Philanthropy:

Philanthropy is an important part of many people's financial

plans. Kamal Lidder helps his clients develop a philanthropic strategy that aligns

with their values and goals. He works with his clients to identify charitable

organizations that are a good fit, develop a giving plan, and maximize the

impact of their donations.

Conclusion

Wealth management is an essential component of financial planning.

It involves developing a comprehensive strategy to manage investments, taxes,

retirement, estate planning, and more. Kamal Lidder, an Investment Advisor with

Canaccord Genuity Wealth Management, helps his clients achieve their financial

goals by developing tailored investment strategies, retirement plans, estate

plans, tax plans, and philanthropic strategies.

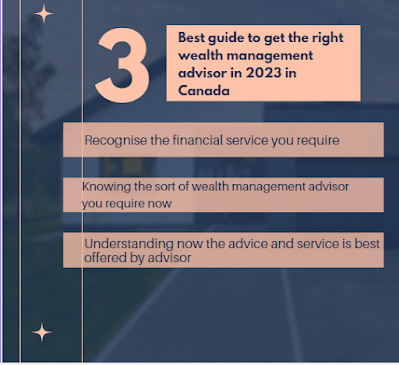

Frequently Asked Questions and Answers:

Ques1: What services does Kamal Lidder

provide?

Ans: kamal Lidder

provides a range of asset management services for professionals and businesses,

including asset management, retirement planning, tax planning, estate planning,

and services for philanthropic organizations.

Ques2: What are the 5 types of wealth management?

Ans: There are

five main types of wealth management, all of which a qualified financial

advisor can help you with financial planning, asset allocation, asset

management, estate planning, and tax accounting.

Ques3: What

does wealth management do?

Ans: Wealth managers provide

holistic financial advice to help their clients grow and protect their wealth.

This advice goes beyond just providing advice on a client's investments or

designing a financial plan for them. Wealth managers generally work with

clients with a higher net worth than a financial planner might.

Comments

Post a Comment