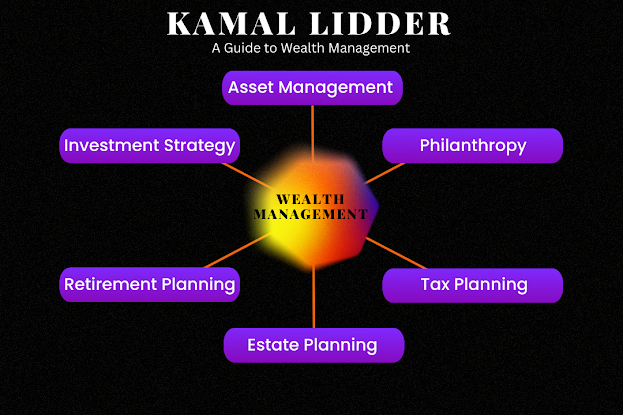

A Guide to Wealth Management with Kamal Lidder

Kamal Lidder is an investment advisor at Canaccord Genuity Wealth Management. He joined Canaccord Genuity Wealth Management, a global company that provides customized financial solutions, to provide individuals and organizations with the independent advice and guidance they need to optimize their finances. Wealth management is a comprehensive approach to managing one's financial resources, including investments, taxes, retirement, and estate planning. In this guide, we will explore the key components of wealth management and how Kamal Lidder helps his clients achieve their financial goals. Kamal Lidder What is Wealth Management? Wealth management is a strategic approach to managing one's financial resources. It involves developing a comprehensive plan to manage investments, taxes, retirement, estate planning, and more. Wealth management is not just for the wealthy; it is for anyone who wants to take control of their finances and plan for the future. 1. Asset Management for ...