Wealth Management Insights: Poor Conduct of the Wealthiest People

.jpeg)

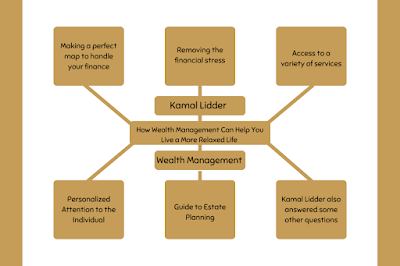

Kamal Lidder explained w ealth management is a critical aspect of personal finance, but it can be challenging for many people to handle effectively. One of the biggest struggles that people face when it comes to managing their wealth is a lack of understanding of the basics of money management. For example, many people are not familiar with the different types of investment options available to them or how to properly diversify their portfolios. Another common struggle is a lack of discipline when it comes to budgeting and saving. Many people find it difficult to stick to a budget and save money consistently, which can make it challenging to build wealth over time. Additionally, there is a tendency to overspend on non-essential items, which can lead to financial stress and a lack of savings. Kamal Lidder explained poor conduct of the wealthiest people is a common topic of discussion among wealth managers. We often see individuals who have accumulated significant wealth but strugg...

.png)